|

|

8 years ago | |

|---|---|---|

| profin | 8 years ago | |

| .gitignore | 8 years ago | |

| LICENSE | 8 years ago | |

| README.md | 8 years ago | |

| betty_graph.png | 8 years ago | |

| betty_txt.png | 8 years ago | |

| example_betty.py | 8 years ago | |

| example_bob.py | 8 years ago | |

README.md

ProFin - Personal Finance Projector

__

o /' )

/' ( ,

__/' PRO ) .' `;

o _.-~~~~' ``---..__ .' ;

_.--' b) ``--...____.' .'

( _. )). `-._ <

`vvvvvvv-)-.....___.- `-. __...--'-.'.

`^^^^^'-------.....`-.___.'----... .' `.;

jgs `-` `

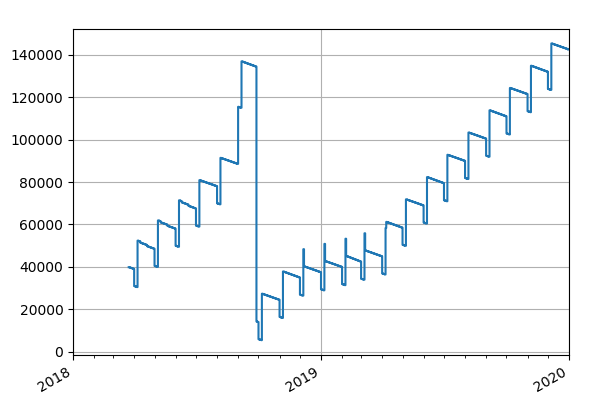

ProFin is a python module for projecting the balance of a personal savings account over a future period.

The output can be used to visualise the balance development when planning some big purchase or a change of the living situation, such as buying a flat or a car, getting a new job with possible months of no income, etc.

Please note the script is intended only for orientation and there may be minor inaccuracies or bugs (please report!)

Supported Features

Financial Operations & Schemes

- Once-off expenses and income

- Recurrent monthly payments / income at a fixed date

- Monthly payments with a total expense cap

- Skipping a month in monthly payments / income

- Spread monthly expenses (e.g. food cost) - distributed over all days in a month

- Simple loan (borrowing money from a friend) with back-payments

- Setting initial or correction balance

Functions

- Setting up a financial situation with changes at arbitrary dates

- Simulating account balance with day granularity

- Plotting results using PyPlot

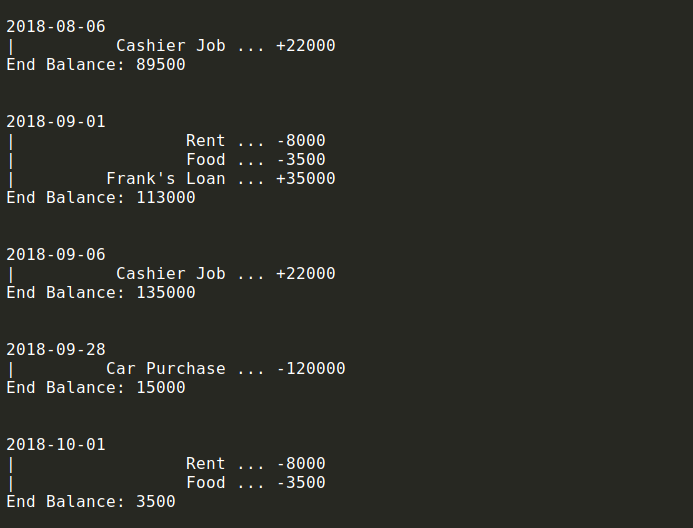

Example with Betty's car purchase

(note: spreading was switched off for a more readable display here, so the values are slightly different from the graph below which has spreading enabled)

Dependencies

The script uses NumPy, MatPlotLib and Pandas for plotting. This may be improved in a future version (in particular Pandas could be replaced).

If plotting is not needed and the dependencies are not available (e.g. some old Debian), remove their imports and comment out the graph() function

Examples

See the example files for an example of usage. (The examples are silly and not very representative, but they show the API well). Additionally the code is documented with doc comments.

Usage example

ProFin is used by writing a configuration script in Python. First create the projector:

import profin

pf = profin.Projector()

Now set the initial balance and the start date. This is the start of the simulation, which is done day by day. This is a fluent API, date() returns self.

pf.date(2018, 'March', 24).balance(+40_000)

The next part is setting up recurrent and once-off expenses and incomes and their changes. This will be better explained below. The last bit is where we run the simulation:

samples = pf.project_to(2019)

pf.graph(samples)

samples is an array of record when the abalnce changed that we cna plot using the graph() method.

API overview

ProFin works with two types of objects: the profiler, and incomes. Expense is a negative income and is internally represented the same way.

Generally all methods return the object itself for easy chaining, with the exception of Projector methods like monthly, single etc,

which are shortcuts for creating income instances.

Months can be numeric 1-12 or textual e.g. jan or January (case is ignored)

Projector API

-

pf.date(year, month, day)- set time cursor. This is used for subsequently created incomes as a starting date, or for their.start()and.end()methods when used without arguments. Day is optional and defaults to 1 -

pf.project_to(year, month, day, verbose)- Run the simulation. month, day and verbose are optional,monthanddayare by default Dec 31,verboseis True.verbosedefines if we want to show updates in stdout when simulating. Returns a array ofsamplesfor plotting. -

pf.graph(samples, currency)- draw samples fromproject_to()using pyplot. Currency is appended to values for display only -

pf.balance(money)- set balance. when called in places other than at the beginning, this resets the balance at the given date resulting in a sharp change in the graph. -

pf.monthly(name, income, day=1)- define a monthly income or expense of monthly valueincome, paid on dayday. This returns a MonthlyIncome object. Name describes the income / expense in the stdout log. -

pf.single(name, money)- once-off income or expense, returns aSingleIncome. -

pf.expend(name, money),pf.receive(name, money)- aliases ofsinglethat also ensure the money value has the right sign -

pf.borrow(name, money)- describes a received interestless loan, returns aSimpleLoan.

MonthlyIncome API

mi.on(day)- set the pay day in the monthmi.skip_month(year, month)- skip a month's paymentmi.start(year, month, day)- set start date (month, day default to Jan 1) If no args given, take current cursor's datemi.end(year, month, day)- end the payments. If no args given, take last day of current cursor's monthmi.total(total)- set a total money cap, after it's exhausted the payments stopmi.spread(yes=True)- enable or disable spreading. This distributes the price across the month's days for a more realistic graph in some cases

SingleIncome API

si.on(year, month, day)- set the date of the payment, default - use cursor's date. month and day default to Jan 1

SimpleLoan API

This is a composite income that is made up of a SingleIncome and a MonthlyIncome with a negative total and per_month.

loan.on(year, month, day)- set reception date, month and day are optional, default to Jan 1loan.repay_monthly(payment, day)- specify monthly repayments on a given dayloan.begin(year, month)- set start month for repayments